- Joined

- Oct 12, 2023

- Messages

- 195

- Reaction score

- 36

Back in January, we laid out the biggest domain sales wins of 2024 and mapped bold predictions for 2025. Six months on, our calls are already playing out in real time. From the record-shattering Icon.com sale to a surge of six-figure .ai deals, the market has sprinted past the milestones we expected by year-end.

In this mid-year check-in we circle back for a status update: which trends are accelerating, which sectors are cooling, and what fresh opportunities are emerging for founders and investors who still need the perfect domain name. Dive in to see how 2025’s first half is playing out and what moves you can make before year-end.

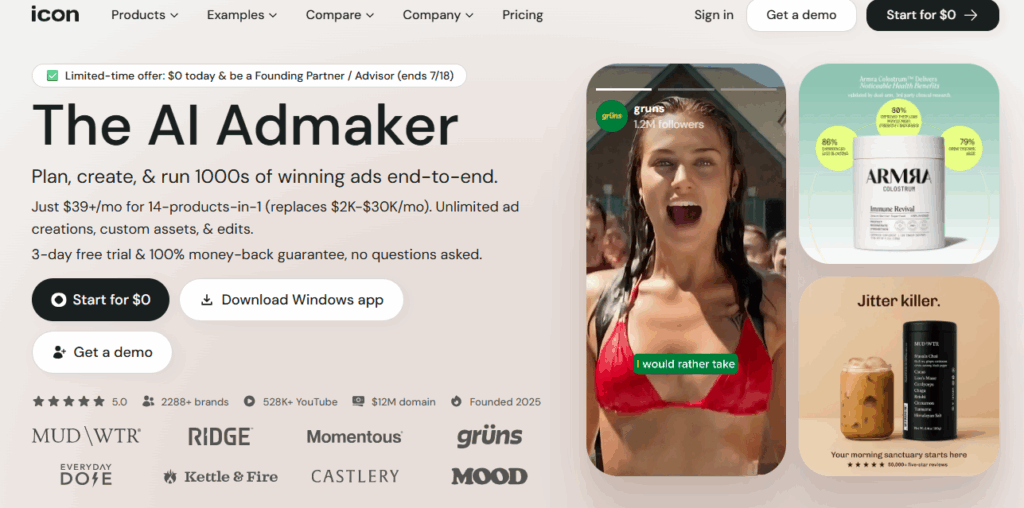

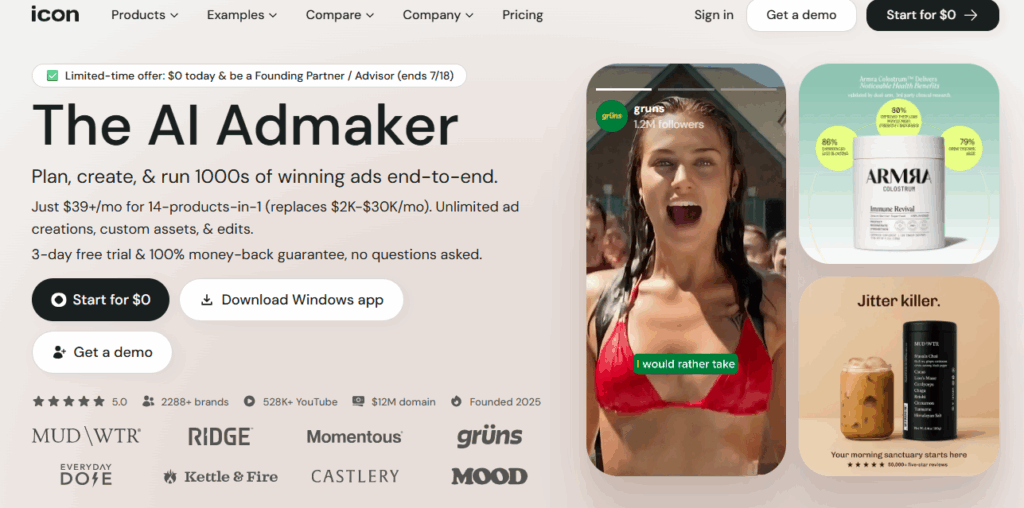

According to Namebio, publicly-reported top-100 domain aftermarket sales in the first six months of 2025 already top US $20 million, led by Icon.com at $12 million, bought by an AI martech startup.

Source: icon.com

2024 was a blockbuster year, but 2025 is on pace to match – and in some niches, out-perform – last year’s record-setting numbers. While H1 2025 still hasn’t shown a public deal to top up the record of 2024 (Rocket.com for $14m) or 2023 (Chat.com for $15.5m), it’s definitely off to a good start.

Source: Namebio

Source: Namebio

Source: Rank.ai

Source: Unsplash

Credibility still costs

If you’re early-stage, secure the best version of your name before you hit Series A pricing territory. Set alerts on your target names and use recent sales to benchmark realistic budgets.

Niche extensions can punch above their weight

The rise of .ai shows that a well-aligned extension can justify six figures. If you serve a clearly defined sector (e.g., AI, fintech, green tech), an industry-signal TLD can deliver instant relevance. Extensions like .it.com let you secure on-brand defensive registrations, especially relevant for the IT startups.

Source: Unsplash

Short pays off

Five-to-six-letter single word (think Fuse or Mine), two-word combos or domain hacks dominate investor wish-lists. Likewise, on alternative extensions like .it.com, brevity boosts memorability and SEO friendliness. List 3-5 words that capture your USP (unique selling proposition) and tone and check the availability now on .it.com – with fewer clashes, more choice.

Prepare for a higher floor

Year-to-date’s top-100 hovers near $70k vs ~$85k last year, but the bottom of the top-10 in 2025 ($680k) is already above last year’s ($550k). Great names are increasing in cost (as is the value of this asset class); budgeting early is essential.

If H1 is any indication, 2025 will finish with:

Whether you’re funding a VC-backed AI platform or launching a local bakery, the domain market’s direction is clear: quality, clarity, brevity (and IT) command premium prices. Understanding the shifting balance between legacy .com powerhouses and fast-rising niche TLDs equips you to invest wisely – and stand out online.

Stay up-to-date with market trends – visit it.com Domains blog and follow us on social media.

Continue reading on the it.com Domains blog...

In this mid-year check-in we circle back for a status update: which trends are accelerating, which sectors are cooling, and what fresh opportunities are emerging for founders and investors who still need the perfect domain name. Dive in to see how 2025’s first half is playing out and what moves you can make before year-end.

Year to Date: Market Is Heating Up

According to Namebio, publicly-reported top-100 domain aftermarket sales in the first six months of 2025 already top US $20 million, led by Icon.com at $12 million, bought by an AI martech startup.

Source: icon.com

2024 was a blockbuster year, but 2025 is on pace to match – and in some niches, out-perform – last year’s record-setting numbers. While H1 2025 still hasn’t shown a public deal to top up the record of 2024 (Rocket.com for $14m) or 2023 (Chat.com for $15.5m), it’s definitely off to a good start.

| Rank | Domain | Price | Date | Why it’s notable |

| 1 | Icon.com | $12m | 24 Apr | 6th-largest sale ever – AI marketing startup upgrade |

| 2 | Commerce.com | $2.2m | 18 Feb | First seven-figure sale of 2025; exact-match e-commerce term |

| 3 | Fuse.com | $2.13m | 20 May | Short, versatile brand word; buyer represented by QEIP |

| 4 | GX.com | $1.2m | 11 Mar | Rare two-letter .com; bought via Sedo |

| 5 | Slash.com | $1m | 22 May | Clean one-word tech brand |

| 6 | Double.com | $980k | 19 Mar | Near-seven-figure sale brokered by “Mr Premium” |

| 7 | spend.com | $802.5k | 23 Jan | Record DropCatch expiry auction |

| 8 | ABTC.com | $700k | 8 Apr | Crypto-friendly four-letter .com |

| 9 | Mine.com | $680k | 28 Apr | Premium verb/noun; fierce expired-auction battle at DropCatch |

| 10 | pack.com | $600k | 21 Jan | Logistics/CPG brand potential |

Source: Namebio

Six Trends Shaping 2025 (so far)

- Seven- and eight-figure .coms are alive and well. High-value .coms persist in the top-100 leaderboard, however, with more diversity. Demand for ultra-short .coms (GX.com) continues, but mid-tier brandables and niche industry domains rise.

- Share of .com is slipping. In 2024, .com captured 19 / 20 biggest deals but only 52% of the full Top-100 list, down from 68% in 2023. In 2025 to date, non-.coms cover 46% of Top-100 deals.

- .ai momentum accelerates. 12 .ai domain names were sold for over $100k in six months, and the share of .ai zone in top-100 sales to date jumped to 29%. Some of the prominent deals in the .ai zone in H1 2025 include:

| Domain | Price | Date | Why it’s notable |

| Rush.ai | $300k | 3 May | Highest .ai sale YTD; flipped from $6k in 2023 |

| seed.ai | $225k | 13 May | In a tie for #4 overall (with Breeze.ai) and as the second-highest .ai sale of 2025 so far |

| Zip.ai | $200k | 27 Mar | Seller’s only .ai name — 124x ROI |

| Rank.ai | $200k | 17 Jun | Ties Zip.ai — SEO/ML branding |

| Turbo.ai | $165k | 20 Mar | Fast-sounding single word; Namecheap brokerage |

Source: Namebio

Source: Rank.ai

- Ultra-short, dictionary words dominate premium prices. Median length of the top-tier 2025 deals is 5 letters, down from 5.6 in 2024 – the appetite for concise exact match generics peaks (think create.it.com), driving demand for premium domains. Creative spellings and domain hacks, enabled by new top-level domains (my.bet, love.now) gain momentum.

- Summer is hotter than usual. In a strong indicator for the overall market, summertime sales are progressing at an unusually strong pace. While historically quieter in aftermarket transactions, this summer is hot, hot, hot. Plus, despite recent lagging in .com sales, Verisign has just released its earnings report with improved guidance.

- IT stays a hot vertical. Alongside an array of names sold in the .ai zone, tech-focused domains like agenticai.com, weaverobotics.com, and virtualassistants.com were sold for over $100k each.

Source: Unsplash

Why Should You Care – and What to Do Next

Credibility still costs

If you’re early-stage, secure the best version of your name before you hit Series A pricing territory. Set alerts on your target names and use recent sales to benchmark realistic budgets.

Niche extensions can punch above their weight

The rise of .ai shows that a well-aligned extension can justify six figures. If you serve a clearly defined sector (e.g., AI, fintech, green tech), an industry-signal TLD can deliver instant relevance. Extensions like .it.com let you secure on-brand defensive registrations, especially relevant for the IT startups.

Source: Unsplash

Short pays off

Five-to-six-letter single word (think Fuse or Mine), two-word combos or domain hacks dominate investor wish-lists. Likewise, on alternative extensions like .it.com, brevity boosts memorability and SEO friendliness. List 3-5 words that capture your USP (unique selling proposition) and tone and check the availability now on .it.com – with fewer clashes, more choice.

Prepare for a higher floor

Year-to-date’s top-100 hovers near $70k vs ~$85k last year, but the bottom of the top-10 in 2025 ($680k) is already above last year’s ($550k). Great names are increasing in cost (as is the value of this asset class); budgeting early is essential.

Looking Ahead

If H1 is any indication, 2025 will finish with:

- More six-figure .ai deals – and possibly the first public seven-figure sale in the extension.

- More (hopefully public) 8 and/or 9 figure .com transactions.

- A new, higher entry bar for Top-100 status.

Whether you’re funding a VC-backed AI platform or launching a local bakery, the domain market’s direction is clear: quality, clarity, brevity (and IT) command premium prices. Understanding the shifting balance between legacy .com powerhouses and fast-rising niche TLDs equips you to invest wisely – and stand out online.

Stay up-to-date with market trends – visit it.com Domains blog and follow us on social media.

Continue reading on the it.com Domains blog...